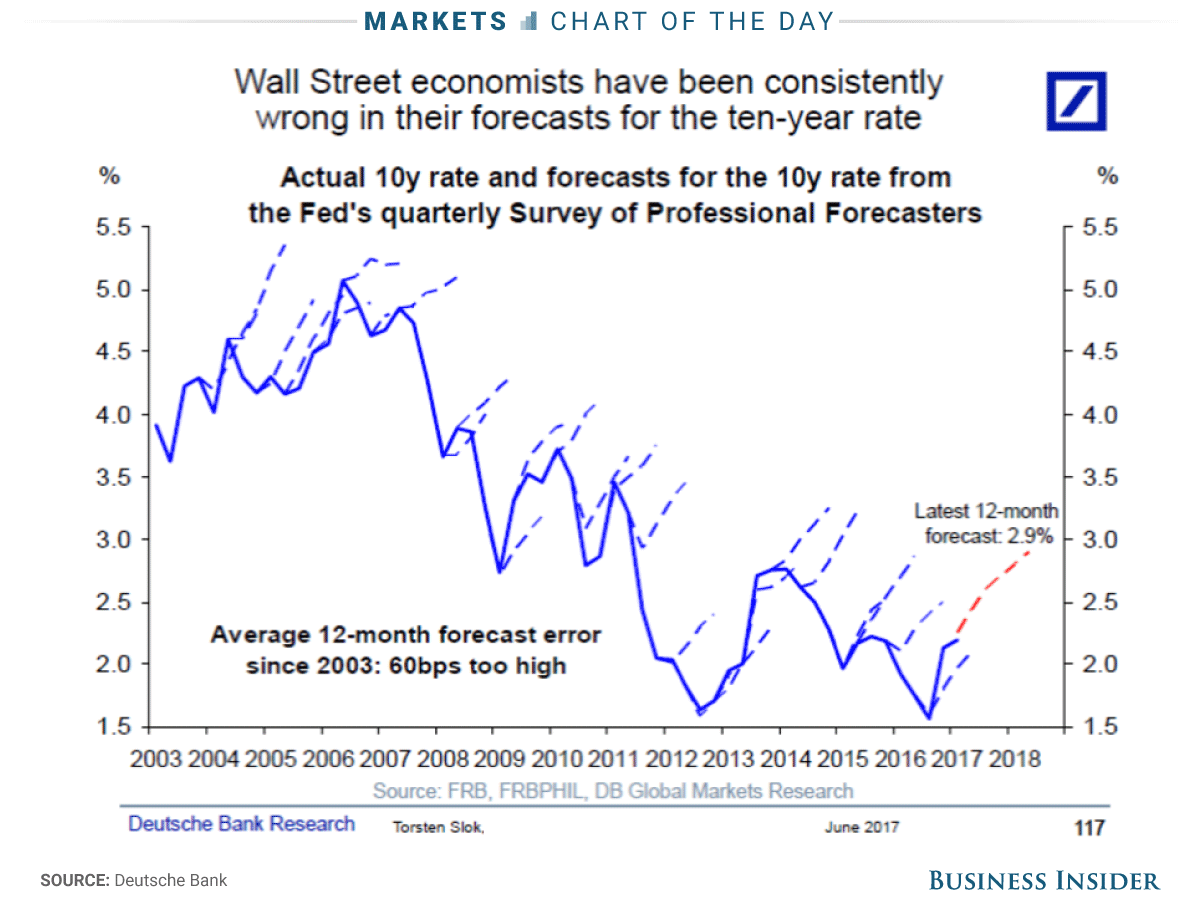

Wall Street strategists have been brutally wrong when it comes to making predictions for the 10-year yield, one of the most economically important interest rate benchmarks – used to set the rates on mortgages and other loans.

The Fed’s Survey of Professional Forecasters for 2017 showed that – heading into the second quarter – Wall Street was expecting the benchmark yield to rise to 2.90% over the next 12 months. Those forecasts were made on the heels of Donald Trump’s election victory as his agenda was supposed to bring inflation back to the US.

The 10-year ticked to a high of 2.64% on March 13, two days before the Federal Reserve raised rates for the first time in 2017 and third time since the financial crisis. But yields have been drifting lower ever since, putting in a low of 2.11% on June 14, as disappointing retail sales and inflation data preceded the Fed’s second rate hike of the year.

As Deutsche Bank’s Torsten Sløk points out, this seems to be a reoccurring theme. Writing in a recent note to clients, he said “the problem is that Wall Street economists have been consistently too optimistic for the past 15 years.”